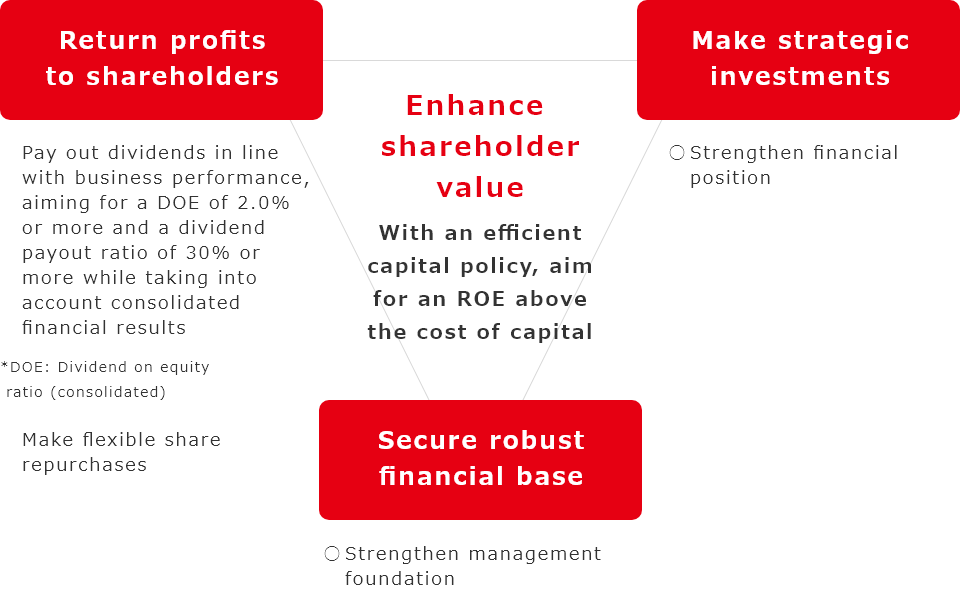

A policy to balance the return of profits to shareholders, securing financial base, and strategic investments.

Our Basic Capital Policy is based on a balanced consideration of strategic investments in order to achieve sustainable growth and enhance corporate value over the mid-to-long term, while striving for continuous and stable returns to shareholders and securing a strong financial base.

We regard consolidated return on equity (ROE) as an important indicator for improving shareholder value.

From a medium- to long-term perspective, we will strive to increase shareholder value by implementing efficient capital policies and aiming for ROE that exceeds the cost of capital.

"As for profit distribution, we lay emphasis on being fair and impartial for all stakeholders. Our basic policy is to return appropriate profits to our shareholders while seeking to strengthen our financial position and management foundation.

Specifically, we will strive to pay continuous and stable dividends, aiming for a dividend on equity ratio (DOE) of 2.0% or more, taking into consideration the consolidated net assets and consolidated results, while balancing retained earnings.

The Company's basic policy is to distribute dividends from surplus twice a year, at the interim and year-end.

Pursuant to Article 459, Paragraph 1 of the Companies Act, the Articles of Incorporation stipulate that decisions on dividends may be made by a resolution of the Board of Directors, rather than by a resolution of the General Meeting of Shareholders.

With respect to share repurchases, we will be handled flexible manner, while considering the level of necessary retained earnings,as well as changes in the business environment, stock price trends, financial conditions, and other factors.

1. Policy on Holding and Acquiring Treasury Shares

We hold a certain amount of treasury shares to ensure flexibility in business investments, including stock-based compensation for directors and executive officers, as well as the execution of M&A strategies.

We regard shareholder returns as an important management measure and will acquire treasury shares as appropriate, taking into account the overall payout ratio while maintaining stable dividends.

2. Policy on the Cancellation of Treasury Shares

We use approximately 5% as a guideline for the ratio of treasury shares.

If this ratio exceeds 10% at the end of a fiscal year, the Company will, in principle, cancel treasury shares in the following fiscal year to reduce the holding ratio to approximately 5%.